DNB Grønt Skifte (Green Shift)

Allow savings to grow in mutual funds that focus on sustainability for people and the environment.

For anyone wanting a fund that takes extra care of the environment and social matters.

The combination funds only consist of sub-funds with a sustainability theme

On a mobile phone, you buy DNB Grønt Skifte in The Spare app

You can buy DNB Grønt Skifte in the online bank using a computer or in the Spare app.

DNB Grønt Skifte (Green Shift)

DNB Grønt Skifte (Green Shift) is a series of balanced funds that aims to contribute to the green shift. By investing in these funds, you can grow your savings in a fund that focuses on sustainability for people and the environment.

Benefits of DNB Grønt Skifte (Green Shift)

- You can choose between four funds based on the level of risk you want

- The funds take ESG factors into account

- DNB Grønt Skifte (Green Shift) consists only of mutual funds with a sustainability profile

- Invests in companies that we think are well positioned for the green shift.

DNB Grønt Skifte (Green Shift) series

DNB shall be a driving force for sustainable transition. To succeed in this ambition, we have established a series of balanced funds with a sustainability profile.

We have done this so that customers can easily make sustainable choices and contribute to the green shift.

DNB Green change explained in 55 seconds!

Savings expert Stian Revheim tells you about the DNB Grønt Skifte funds.

Select the mutual fund that suits you best

Each of the funds we offer within DNB Grønt Skifte (Green Shift) is subject to specific sustainability criteria. This means that they pay extra attention to matters related to environmental, social and management issues.

You can choose between four different balanced funds with different risk profiles.

DNB Grønt Skifte 100

The fund consists of 100 % shares

- Buy DNB Grønt Skifte 100 in the online bank

- Buy on mobile in the Spare app

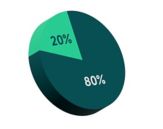

DNB Grønt Skifte 80

The fund has approximately 80 % investments in shares and 20 % in fixed-income securities

- Buy DNB Grønt Skifte 80

- Buy on mobile in the Spare app

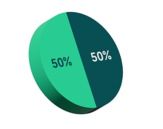

DNB Grønt Skifte 50

The fund is roughly divided 50/50 between investments in shares and fixed-income securities.

- Buy DNB Grønt Skifte 50

- Buy on mobile in the Spare app

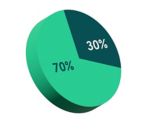

DNB Grønt Skifte 30

The fund has approximately 30 % investments in shares and 70 % in fixed-income securities

- Buy DNB Grønt Skifte 30

- Buy on mobile in the Spare app

Costs for DNB Grønt Skifte Combination fund A | |||

|---|---|---|---|

Annual cost (= ongoing cost + platform fees) | Current cost | Platform fee | |

DNB Grønt Skifte 100 | 1.15% | 0,85 % | : 0.30 % |

DNB Grønt Skifte 80 | 1,05 % | 0,75 % | : 0.30 % |

DNB Grønt Skifte 50 | 0,90 % | 0,65 % | 0,25 % |

DNB Grønt Skifte 30 | 0.80% | 0,55 % | 0,25 % |

Price example: | For an amount of NOK 100,000 invested in DNB Grønt Byte 100, the platform fee will amount to NOK 300 and the running costs will amount to NOK 850 over the course of one year. In total NOK 1150 per year. | ||

Read more about our Pricing model for mutual funds. | |||

The green shift is about how we will become a low-emission society by 2050. To achieve this goal, a transition must take place to products and services that have significantly less negative consequences for the climate and the environment than today.

The changeover will be demanding, but entirely possible. DNB Grønt Skifte (Green Shift) is a series of balanced funds that aims to contribute to the green shift. By investing in these funds your savings have the chance to grown in a mutual fund that focuses on sustainability for people and the environment.

Why invest in the green shift?

By investing in DNB Grønt Skifte (Green Shift) you will invest in:

- Companies that are well positioned for the green shift.

- Funds with a higher share of sustainable investments (8+)

- Funds and companies that have a low carbon risk

- In a world that moves towards a low carbon society, there will be greater risk associated with investing in companies that are not in transition, therefore the combination funds invest in companies that are well-positioned for the green shift

- Investments in companies that are working on solutions to different climate and environmental challenges and that are taking initiatives towards the green shift

Reduction of greenhouse gas emissions

Climate adaptation

Sustainable use of water and marine resources

Transition to circular economy

Reduction of pollution

Protection of ecosystems

Sustainability in mutual funds and in our advice

SFDR is the regulation in the EU action plan for sustainable finance. SFDR ensures that financial institutions publish their financial products’ investment strategy, investment objectives and actual investments.

Our eco fund

DNB Future Waves

Actively managed, global equity fund.

DNB Klima Indeks (Climate Index)

Index-following global fund

DNB Miljøinvest (Eco invest)

Actively managed, global equity fund.

DNB Grønt Norden (Green Nordic)

Actively managed, Nordic equity fund.

DNB Global Lavkarbon (Low Carbon)

Actively managed, global equity fund.

DNB Barnefond (Children’s fund)

Index-following equity fund

DNB Low Carbon Credit

Actively managed, global bond fund