Active management

Pension profiles with active management

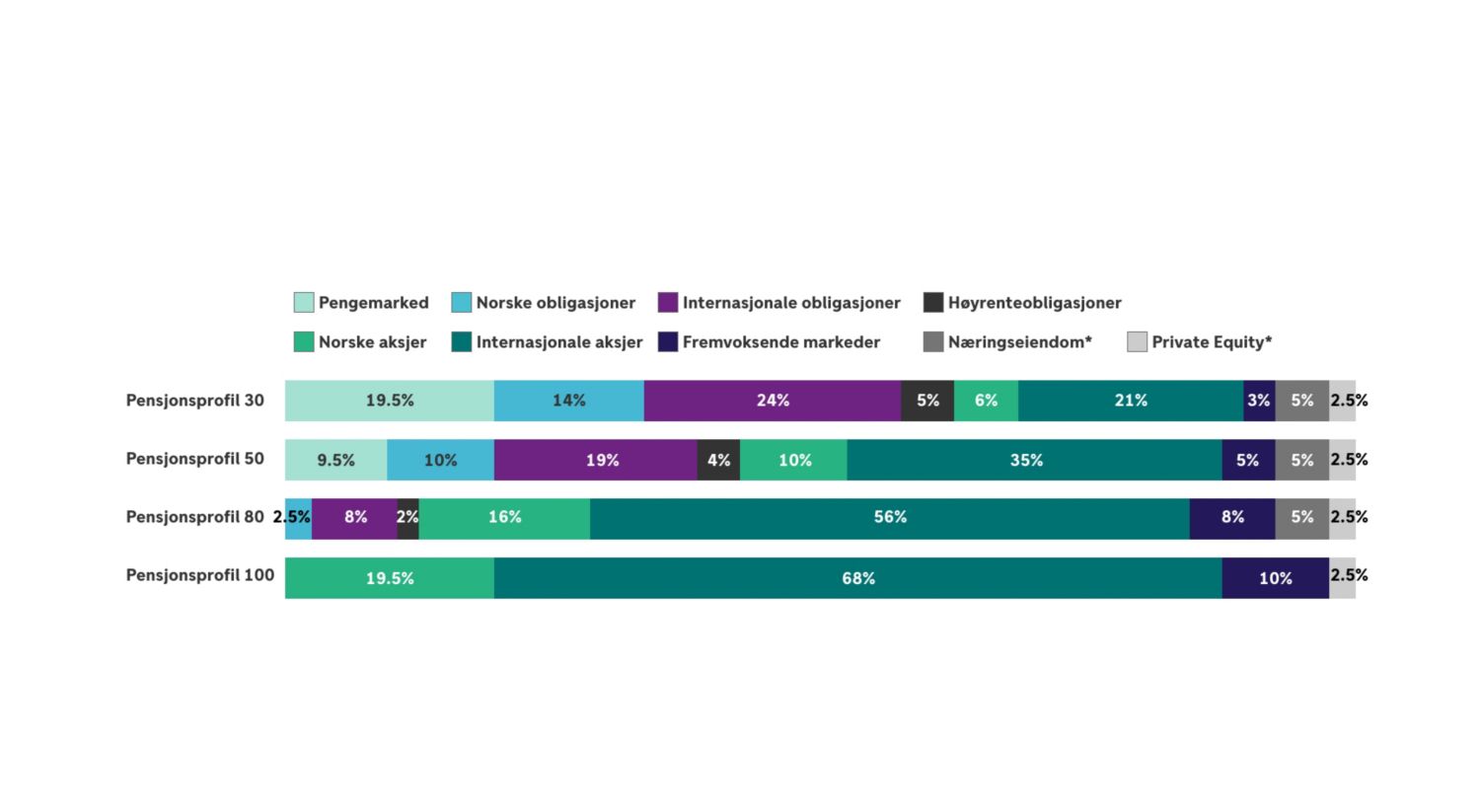

Mutual funds and portfolios are actively managed. The managers for the underlying markets choose the companies they think will produce the best return. The return on the portfolio is measured against relevant market indices and it is expected that the active management over time will provide a better return than the market indices. In addition, the actively managed pension profiles invest in markets that are especially suitable for active management, such as high-yield bonds and commercial property.

Last quarter’s market report (PDF)Open the file in a new tab

*investments in commercial property and private equity funds are not listed shares, they are included in alternative investments